Flat depreciation calculator

Depreciation asset cost salvage value useful life of asset. The calculator should be used as a general guide only.

Pin On Make Money

In fact the cost of your new car drops as soon as you drive it off the dealership lot.

. This depreciation calculator will determine the actual cash value of your Curling Flat Iron using a replacement value and a 10-year lifespan which equates to 01 annual depreciation. This is the remaining. This depreciation calculator will determine the actual cash value of your Modified Bitumen - Flat using a replacement value and a 10-year lifespan which equates to 01 annual depreciation.

Subtract the estimated salvage value of the asset from. Determine the cost of the asset. The depreciated value of the property is 1060 ie.

Flat depreciation calculator. It provides a couple different methods of depreciation. This depreciation calculator will determine the actual cash value of your Flat Built-Up using a replacement value and a 12-year lifespan which equates to 012 annual depreciation.

For example if you have an asset. The straight line calculation steps are. How to Calculate Straight Line Depreciation.

When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. Deduct this depreciation from the construction cost of the property and add the appreciated land value to compute the. There are many variables which can affect an items life expectancy that should be taken into consideration.

Number of years after construction Total useful age of the building 2060 13. Car depreciation refers to the rate at which your car loses its value from the first year you bought it. Straight Line Depreciation Method.

This depreciation calculator is for calculating the depreciation schedule of an asset. The Depreciation Guide document should be used as a general guide only. The four most widely used depreciation formulaes are as listed below.

January 1 2021 In Street Photography By. First one can choose the straight line method of. Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules.

There are many variables which can affect an items life expectancy that should be taken into consideration. Also includes a specialized real estate property calculator. In such cases depreciation is arrived at through the following formula.

Percentage Declining Balance Depreciation Calculator.

Depreciation Schedule Formula And Calculator Excel Template

Depreciation Rate Calculator Discount 57 Off Www Ingeniovirtual Com

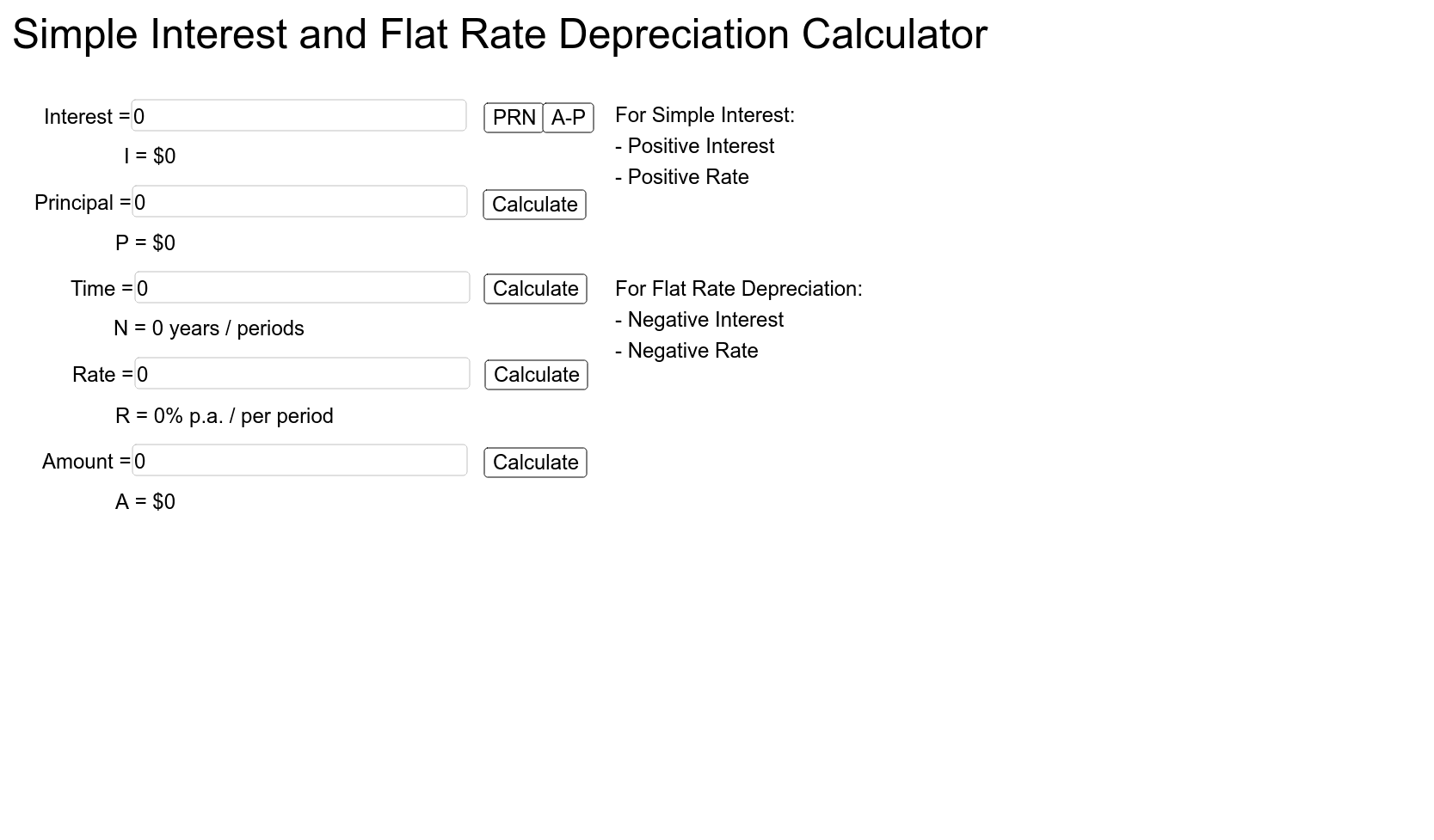

Simple Interest And Flat Rate Depreciation Calculator Geogebra

Salvage Value Formula Calculator Excel Template

Download Depreciation Calculator Excel Template Exceldatapro

Payback Period Calculator Double Entry Bookkeeping Payback Period Calculator

Depreciation Calculator Definition Formula

Depreciation Rate Formula Examples How To Calculate

Car Depreciation Chart How Much Have You Lost Infographic New Cars Financial Tips Two Year Olds

Depreciation Formula Calculate Depreciation Expense

Download Depreciation Calculator Excel Template Exceldatapro

How To Calculate Depreciation Expense

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Free Depreciation Calculator Online 2 Free Calculations

Depreciation Formula Calculate Depreciation Expense

Rental Property Depreciation Calculator Top Sellers 51 Off Www Ingeniovirtual Com

Depreciation Formula Calculate Depreciation Expense