Ira penalty calculator

How We Calculate the Penalty We calculate the Failure to Pay Penalty based on how long your overdue taxes remain unpaid. It is mainly intended for use by US.

How To Make An Early Withdrawal From Your Ira Without Paying The Fee Individual Retirement Account Men Casual Retirement Accounts

The IRS charges a penalty for various reasons including if you dont.

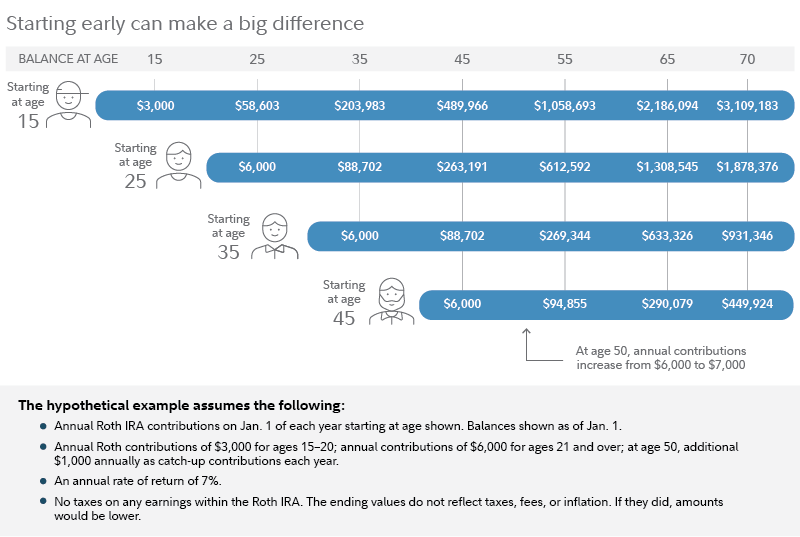

. Taxpayers who dont meet their tax obligations may owe a penalty. Use our traditional IRA calculator to see how much your nest egg will grow by the time you reach retirement. The 72 t Early Distribution Illustration helps you explore your options for taking IRA distributions before you reach 59½ without incurring the IRS 10 early distribution penalty.

If your account is worth 50000 and youve made 10000 in nondeductible contributions you can determine that the nondeductible portion is 20 or 02. Traditional IRA Calculator Details To get the most benefit from this. Ad We Reviewed the 10 Best Gold IRA Companies For You to Protect Yourself From Inflation.

Roth IRA Calculator This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings. 401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator. Unpaid tax is the total tax required to be shown on.

The 72 t Early Distribution Illustration helps you explore your options for taking IRA distributions before you reach 59½ without incurring the IRS 10 early distribution penalty. How is my RMD calculated. Account balance as of December 31 2021.

Only Roth IRAs offer tax-free withdrawals. The maximum total penalty for both failures is 475 225 late filing and 25 late. This IRS penalty and interest calculator provides accurate calculations for the failure to file failure to pay and accuracy-related penalties.

The IRS will calculate the penalty for each required installment of estimated taxes according to how many days your taxes are past due and the effective interest rate for that. Understand What is RMD and Why You Should Care About It. Ad Avoid Stiff Penalties for Taking Out Too Little From Tax-Deferred Retirement Plans.

If you withdraw money before age 59½ you will have to pay income tax. Generally early withdrawal from an Individual Retirement Account IRA prior to age 59½ is subject to being included in gross income plus a 10 percent additional tax penalty. This 401k Early Withdrawal Calculator will help you compare the consequences of taking a lump-sum distribution from your 401k or even your IRA versus rolling it over to a tax-deferred.

Thus the combined penalty is 5 45 late filing and 05 late payment per month. The provided calculations do not constitute financial. Use this calculator to estimate how much in taxes you could owe if.

Your life expectancy factor is taken from the IRS. The income tax was paid when the money was deposited. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset.

We may charge interest on a. More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

Roth Vs Traditional Ira How To Choose Family And Fi Roth Ira Investing Traditional Ira Roth Ira

How To Figure Out The Taxable Amount Of An Ira Distribution 2022

Pin On Financial Independence App

10 Tax Breaks When You Own A Home Infographic If You Re Searching For Information On Tax Benefits Of Owning A Home You Real Estate Buying First Home Estates

How To Pull Your Money Out Of An Ira Or 401 K Early And Penalty Free College Expenses Early Retirement Retirement Fund

Roth Ira Calculator Roth Ira Contribution

Lodging Your Tax Return Blacktown Tax Return Tax Savings Strategy

Pinterest

Is The Solo 401 K Better Than An Ira Llc Ira Checkbook Solo

2020 Roth Ira Contribution Limit Calculator Internal Revenue Code Simplified

Ira Calculator

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

3 Retirement Times Retirement Calculator Retirement Money Retirement Savings Calculator

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

3jyzvuocctnujm

Irs Fresh Start Program How Does It Work Infographic Irs Fresh Start Program Work Infographic